Metaverse Land Prices are Falling: Is it time to buy?

- Analysis

- May 15, 2022

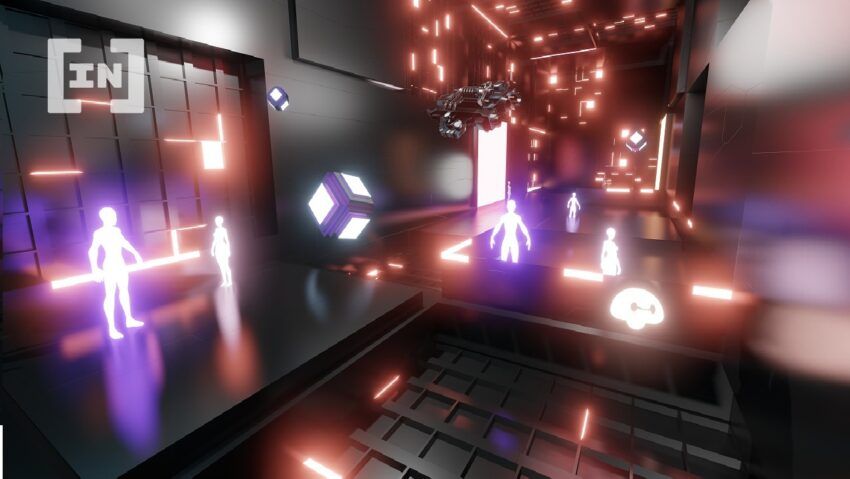

Property prices in the Metaverse have been falling for weeks. Could this be a way to buy?

Land prices in Otherside, the most popular Metaverse project in recent times, have lost 15% of their value. The prices of other Metaverse properties with a high market value are also declining. These include projects such as The Sandbox (SAND), Decentraland (MANA) and Axie Infinity (AXS). But not only the prices for land in the Metaverse are falling, many cryptocurrencies are also having to register losses.

At the end of 2021, Facebook changed its name to Meta. With the launch of the new project, Mark Zuckerberg wanted to stop Facebook’s decline.

Zuckerberg’s plan also initially caused the prices of blockchain metaverse coins to rise. Projects such as The Sandbox, Decentraland, Enjin (ENJ), CEEK, Bloktopia (BLOK) and Pavia experienced an increase in value during this period. But then the news reached the public that Zuckerberg had lost almost $ 3 billion with his meta-project. This did not bode well for the prices of the virtual properties.

Projects with a focus on NFTs also performed well in the first quarter of 2022. A large number of NFT collections produced in the Ethereum ecosystem were able to make a profit for their investors during this period. However, most NFTs on Solana and other networks have lost value.

The current fall in land prices in the Metaverse can be attributed to the general downward trend of the market. However, before this decline began, the land prices of many projects were already on a descending branch.

Axie Infinity, the Metaverse project with the highest transaction volume since the beginning of the year, was shaken by the fact that many players left the project after a major cyberattack. Even after the announcement of fixing the damage in the amount of $ 650 million, the Axie developers could not keep the players on the platform.

When is the Bulls season coming for NFTs?

Altcoins such as SAND, MANA and AXS have lost an average of 40% in the last month. Plots on Otherside initially rose from 2 ETH to an all-time high of 7 ETH before falling back to 4 ETH. Land prices at The Sandbox have recently fallen by 11%. SAND plots are sold on NFT marketplaces such as OpenSea or LooksRare for “only” 1.19 ETH.

Decentraland plots are marketed in the official sales area of the platform and on well-known NFT marketplaces. The cheapest Decentraland property currently costs around 3,800 MAMA or about 5,000 US dollars. Pavia plots on the Cardano (ADA) network are shown on the jpg.store marketplace is offered for 300 ADA.

Even if prices are currently falling, large financial companies such as Ark Investment and Morgan Stanley expect that the gaming and blockchain industries will be among the fastest growing sectors in the next decade. A study by Ark Invest predicts that GameFi projects will become the new tools of social media.

Is it time to buy?

Large companies and institutions continue to buy virtual land. Why? Because digital real estate gives brands a place to bring their goods to the customer in the Metaverse. Even if the branding and sales in this new space are still attractive, the decline in land prices could only be short-lived and prices could soon rise again.

These are definitely interesting times.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.