Crypto Industry: the Stronger One Survives and That’s a Good Thing

- Analysis

- May 15, 2022

In the crypto world, only the strongest survives, says Celia Zeng, DeFi Asset Manager at Cabital.

This week, the price of a major crypto currency, which is allegedly linked to national currencies such as the US dollar, has fallen. Volatility has been the buzzword of the crypto industry in recent months. The short-term factors have superimposed the long-term expectations. This leads to an optimization between the most important players and instruments. The survival of the fittest further strengthens the industry by removing unreliable or unethical stakeholders.

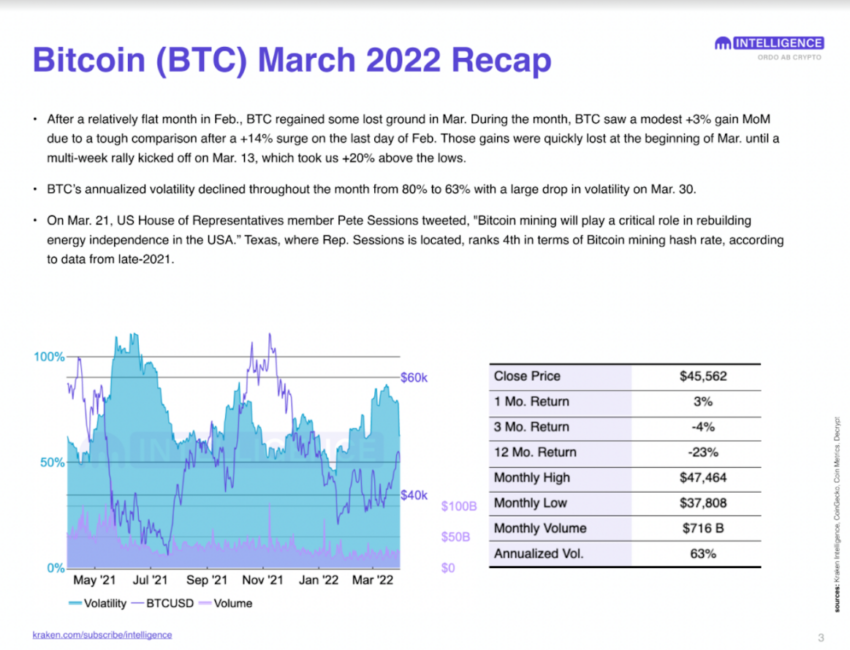

Crypto prices reached their annual low in January and February 2022. This was followed by an increase in March and a decrease in April and May. In the NFTs segment, prices and liquidity have decreased and the number of users has also decreased significantly. On the other hand, well-known names have strengthened their presence from a legal and practical point of view.

Crypto Industry: Increase in Adoption

The Metaverse sector, represented by Decentraland (MANA), Sandbox (SAND) and Axie Infinity (AXS), delivered an excellent performance in February with an annual return of 1851%. BTC and ETH also managed to improve their performance in February and March, before crashing again in April. The role of the largest cryptocurrencies as safe havens further strengthened market leaders.

Curve, MakerDAO and Lido Finance held their top 3 positions among DeFi protocols based on Total Value Locked (TVL). Lido Finance continues to be one of the most undervalued protocols, based on the ratio of market capitalization to TVL. While the DeFi sector saw sell-offs, it continued to outperform traditional cryptocurrencies.

The entry of the largest companies into the crypto sector has become increasingly clear. McDonald’s has filed at least ten trademark applications based on its Metaverse plans. JPMorgan became the first bank in the Metaverse with the opening of the Onyx Lounge in Decentraland. The tickets for Super Bowl LVI included commemorative NFTs. The presence of companies in the crypto industry means a wide user base and more significant capital inflows with increasing demand.

GameFi

GameFi is also trending. Some tech giants like Facebook have already shown their intentions to become part of the metaverse and the gaming sector. Traditional gaming platforms such as UniSoft are planning to integrate blockchain technology into their business and technical models, including the use of NFTs. The NFT market was at about $25 billion in 2021. This year, it is expected to reach a net sales volume of $ 35 billion. Based on the current growth rate, observers of the NFT market predict growth of $ 80 billion by 2025.

The legal aspect of the crypto industry was already showing signs of volatility. The SEC launched an investigation into Mirror Protocol, which allows trading in synthetic versions of popular US stocks.

The commission has even issued subpoenas to the CEO of Terraform Labs after the US District Court judge ordered compliance. The global crypto community has fought off an attempt by the EU and the European Parliament to block or limit proof-of-work assets through its Crypto Assets Bill (MiCa), 61(9c). The Ukrainian parliament passed the draft law on the legalization of cryptocurrencies in February. In March, he was signed by Volodymyr Zelensky.

Investments and venture capital

The investment community saw the temporary decline in the market capitalization of the crypto industry as a solid investment opportunity. Capital investments in the blockchain and crypto industry reached $ 14.6 billion in the first quarter of 2022. That’s almost half of the $30.5 billion invested in the whole of 2021. The early adoption phase of the industry continued to provide a wide range of investment opportunities. In addition, some saw the crypt assets as a defensive asset against a rapidly rising inflation er dollar prices.

The biggest investments: Sequoia Capital and Paradigm invested $1.15 billion in Citadel Securities. That was the biggest deal of Q1 2022 within the crypto industry. The transaction marks a move from Citadel Securities to new asset classes, including crypto. Cross River made a $620 million investment in crypto solutions.

Mergers and Acquisitions: Among the largest mergers and acquisitions in the crypto industry are the acquisition of Diem by Silvergate Capital in January, the acquisition of First Digital Trust by Fireblocks in February and the acquisition of Altonmy by Blockchain.com in March. The Web3 sector attracted the largest share of investments with 26.5% of the total amount in the first quarter of 2022.

Sustainable developments: The crypto industry has also shown how it can stand up for good causes. Decentralized autonomous organizations are stepping up their engagement in the midst of Russia’s war against Ukraine. Ukraine DAO alone raised $ 6.75 million for the benefit of Ukraine through the sale of NFT. The crypto fund set up by the Ministry of Digital Transformation of Ukraine has raised over $ 60 million. These examples show how the crypto industry removes obstacles and bureaucratic hurdles for a good cause.

Risks and hacker attacks

Like any other company or bank, the crypto industry is also vulnerable to hacker attacks. They reveal vulnerabilities of networks and exchanges, through reentrancy attacks, direct hacks or the use of other tools. The good news is that every incident strengthens those involved and the industry as a whole. Vulnerabilities will be eliminated and the backdoor for future hacking attempts will be closed.

The victims of the last attack in March-May 2022 include Agave DAO, Cashio, Revest Finance, Ronin Network, Voltage Finance, Inverse Finance, Elephant Money and Beanstalk. As a rule, the attacks lead to losses in the millions. Of the $ 181 million stolen from Beanstalk, the attackers managed to keep $ 76 million.

Crypto Industry: What does the Future Hold?

The basic data point to a future growth of the crypto industry. The temporary short-term volatility offers investment opportunities and a good basis for mergers and acquisitions. Our tip is “BUIDL” (Build Useful Stuff): build strong infrastructures and invest in trustworthy projects. This avoids the risk that profits will be lost during the down cycle and new capital flows will flow into the industry.

About the author

Celia Zeng is DeFi Asset Manager at Cabital. Cabital simplifies investing in the crypto world without all the noise and drama that comes with it.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.