Trading Crypto Futures and Options with Better Control on Delta Exchange

- Press Release

- February 18, 2026

Control is everything in crypto trading. Without it, even the most promising trades can spiral into unexpected losses. This becomes even more critical when you’re dealing with crypto futures and options – instruments that amplify both opportunities and risks.

For traders in India exploring crypto derivatives, the challenge isn’t just about predicting market movements. It’s about having the tools, clarity, and infrastructure to manage trades confidently.

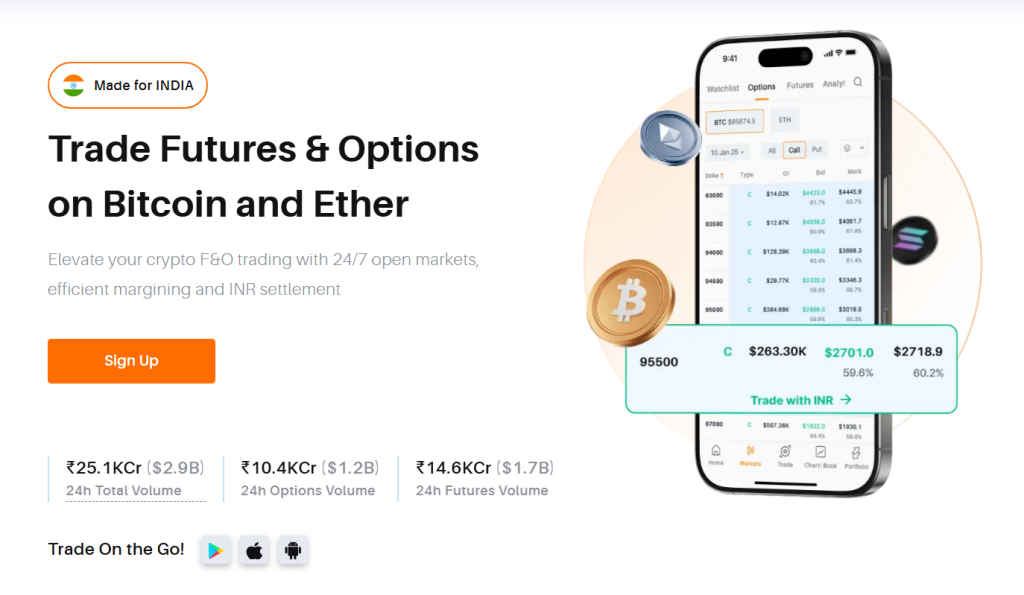

Delta Exchange, one of the top crypto exchanges in India, addresses this by putting control back in the trader’s hands through features designed for precision, transparency, and ease of use.

Let’s explore how the platform helps traders navigate crypto futures and options with better command over their positions.

INR-Settled Crypto Trading

One of the biggest pain points for Indian traders on global exchanges is the hassle of converting INR to crypto, paying conversion fees, and navigating wallet transfers. Delta Exchange eliminates this friction entirely.

With direct INR deposits and withdrawals via UPI or bank transfer, you maintain full control over your capital without unnecessary steps. Every rupee you deposit goes directly toward trading, and profits can be withdrawn in INR – no conversions, no hidden charges.

This seamless flow for crypto derivatives means you’re never stuck wondering where your money is or how much you’re losing in transaction costs.

Leverage Options: Flexibility Without Overexposure

Delta Exchange offers leverage up to 100x on most crypto futures contracts and even 200x on select ones. While high leverage can multiply gains, it also increases liquidation risk.

That’s why the platform gives you complete control over how much leverage to use. You’re not forced into high-risk positions – instead, you can choose conservative leverage levels that match your risk appetite.

For traders who prefer stability, Delta’s trackers operate at 1x leverage, offering exposure to crypto price movements without liquidation fears. This flexibility lets you trade according to your comfort level, not the platform’s defaults.

Risk Management Tools Built Into Every Trade

Control isn’t merely about entering trades – it’s also about knowing when to exit. Here’s how Delta Exchange integrates several risk management features that help traders stay disciplined:

- Stop-loss and take-profit orders: Automate your exits at predefined price levels. This removes the emotional burden of watching charts constantly and helps lock in profits or cut losses automatically.

- Payoff charts: Before confirming any trade, you can view detailed payoff charts showing potential profit and loss scenarios. These charts display breakeven points and maximum risk, giving you a clear picture of what’s at stake.

- Demo trading: Practice with virtual funds in simulation mode. Test strategies, understand contract behavior, and build confidence – all without risking real capital.

These are core features available for every crypto futures and options contract on the platform.

Automation: Control Even When You’re Away

Manual trading has its limits. You can’t monitor markets 24/7, and emotional decisions often creep in during volatile swings. Delta Exchange offers API integrations and algo trading bots that let you automate strategies.

Whether it’s a simple rule-based bot or a complex algorithmic strategy, automation ensures your trades execute based on logic, not impulse. This is especially valuable in crypto derivatives, where price volatility can occur in seconds.

For beginners, automation might sound technical, but Delta keeps it accessible. Even basic strategies can be set up to run hands-free, giving you control over your trades without constant manual intervention.

Small Lot Sizes: Accessible Entry Points

Control also means affordability. You shouldn’t need massive capital to start trading crypto futures and options. Delta offers small lot sizes, making derivatives accessible to retail traders.

BTC contracts start at around ₹5,000, while ETH contracts begin at ₹2,500. These lower entry points let you experiment with strategies, understand market dynamics, and scale up gradually as you gain confidence.

Regulatory Compliance

Trading on a platform registered with India’s Financial Intelligence Unit adds another layer of control: trust. Delta Exchange adheres to anti-money laundering guidelines and operates within Indian regulatory frameworks.

This compliance ensures your funds are handled responsibly and that the platform operates transparently. In a market often clouded by uncertainty, this credibility matters.

The Bottomline

Trading crypto futures and options requires more than market knowledge – it demands control over every aspect of your trades. Delta Exchange delivers this through INR support, flexible leverage, integrated risk tools, automation features, and regulatory trust.

Whether you’re a beginner testing the waters or an experienced trader executing complex strategies, the platform gives you the infrastructure to trade with clarity and confidence.

To start trading crypto futures and options, visit www.delta.exchange or join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency carries a high risk of market volatility. Kindly do your own research before investing.