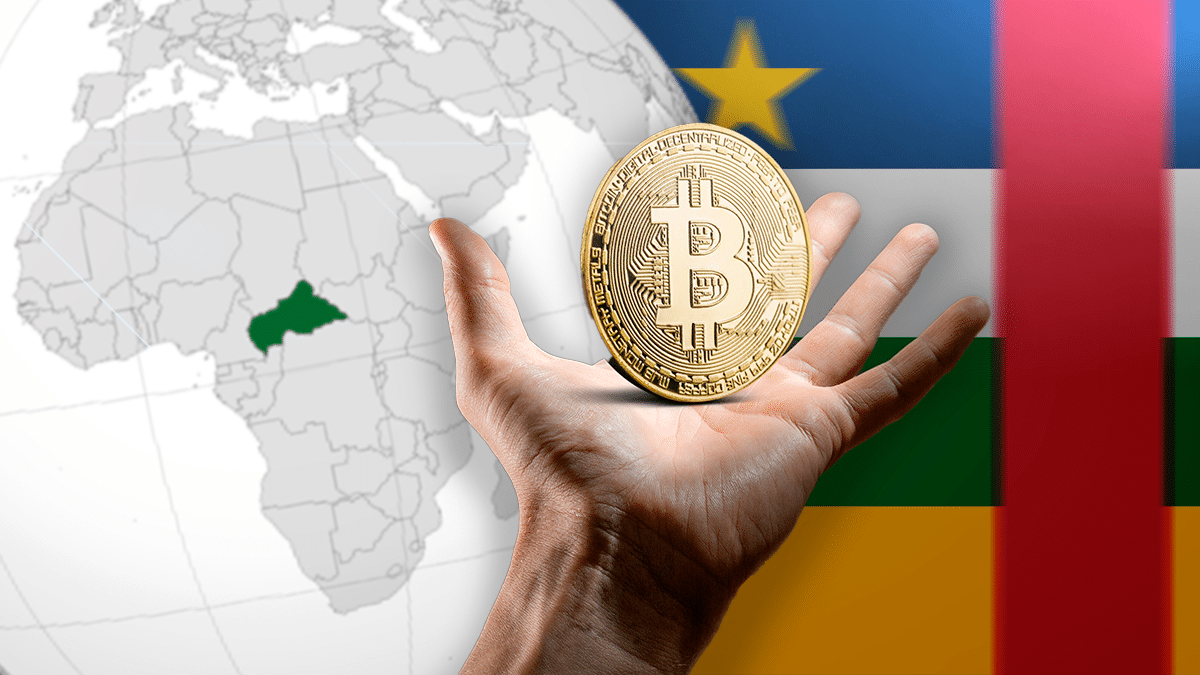

Central African Republic said yes to Bitcoin, but almost no one has the Internet

- Regulations

- May 15, 2022

Key facts:

-

With a GDP of 2,000 million dollars, Bitcoin is more valuable than the entire economy of this country.

-

Only 355,000 people have access to the Internet in this nation of more than 4 million inhabitants.

One of the most important news of the week in the cryptocurrency ecosystem is, without a doubt, the fact that a second country will adopt Bitcoin as legal tender. Following the steps taken by El Salvador last year, the Central African Republic has approved a law that makes the use and acceptance of bitcoin as a means of payment mandatory throughout the territory.

This has generated great expectations in the community bitcoiner, where the sum of a new nation is celebrated, among those that recognize the benefits of cryptocurrency as a store of value and medium of exchange. However, while some are beating drums and cymbals for this news, others are wondering about what is the role of this country in the global economy and the possible impact that its decision could have on the Bitcoin market.

Let’s start with the first thing. The Central African Republic, known by its acronym RCA, is a landlocked country that shares borders with other nations such as Chad, Sudan, Congo and Cameroon. Although it was originally a French colony, since 1960 it has been a totally independent country that held its first elections in 1993. In this way, it became a state with a president, ministers, an assembly and the representation of a supreme court.

Despite its Republican policy, since the 2000s, the country has suffered two civil wars that have cost the lives of hundreds of people. Also, this has had a huge impact on the country’s economy, which had a contraction due to armed disputes, which has led it to become one of the poorest countries in Africa and the whole world, according to data from UNICEF and UNHCR.

Information from the World Bank indicates that its entire Gross Domestic Product (GDP) is equivalent to just over 2,000 million dollars. This economic indicator reflects the monetary value of all products and services generated in the country, of which 58% depend on agricultural activity. And although the country has abundant mineral resources, such as gold, diamonds, uranium and even oil, even so, 67% of its inhabitants are on the poverty line, according to the International Fund for Agricultural Development.

The GDP of the Central African Republic is just over $2 billion. Source: World Bank.

Putting all this in context, it could be speculated that Bitcoin would have the ability to modernize the country’s economy, help it develop in international trade and even enrich its population, where the GDP per capita, per year, does not exceed $ 431. However, the situation is not so simple and this is because telecommunications and Internet services in this African nation are not developed as in other parts of the world.

Central African Republic has a limited Internet connection

While in European or American countries, almost the entire population has a mobile phone in their possession, in the Central African Republic only 33% of its population can enjoy this luxury. Taking into account that the total population of the African country is 4.7 million people by 2022, only 1.64 million are those who own their own phone, according to statistics from GSMA Intelligence.

Even worse are the Internet connection data, shared by sources such as Kepios and Data Reportal, where it is pointed out that there are approximately 355,000 users throughout the country. This equates to less than 8% of the entire population of the republic, which would mean that more than 90% of its inhabitants would not have the possibility to use bitcoin as a payment method.

Although studies indicate that with the COVID-19 pandemic and the quarantines imposed around the world, it is likely that the number of users will continue to increase in 2022, it is still an alarming figure for a country that wants to establish bitcoin as a legal tender. Taking into account that it is necessary to have an electronic device, a wallet cryptocurrency and, of course, Internet connection to be able to receive or send payments with bitcoin. If the majority of the population is in extreme poverty and lives from agricultural activities, is it really feasible to adopt bitcoin throughout the territory? Or will it just be a paper law?

Although we do not have the answers to these questions, without a doubt it is a fact that makes us reflect on the true impact that the adoption of Bitcoin in this African republic could have. Not only is it a country with little capital to generate a strong buying and selling movement in the cryptocurrency market, but it also turns out to have a very precarious infrastructure for its inhabitants to benefit from bitcoin.

On top of that, by 2019, only 14% of the country’s population had direct access to electricity.

In this sense, it is possible that the adoption of bitcoin will remain in the hands of the most privileged in the country, just as it is not yet known if the government will campaign to modernize the nation in order to make this adoption feasible. One strategy that could benefit them, and that El Salvador has also applied, is that the government actively decides to invest in bitcoin to maintain a monetary reserve that is valued over time and enriches its citizens.

However, this is not stated in the law and only time, as well as the policies of the country’s rulers, will be what will dictate the impact that the adoption of cryptocurrency may have on its internal economy.

As for the Bitcoin market, taking into account that its capitalization exceeds 700,000 million dollars -350 times the value of the GDP of the republic— it seems quite limited that this news has a greater impact on the price of bitcoin. However, it is likely that the support of another country, which relies on cryptocurrency, will make Bitcoin gain more and more reputation.